Compensation Report

4. Architecture of compensation of the Group Executive Committee

The compensation of the Group Executive Committee includes a fixed annual base salary, a variable short-term element, a variable long-term element, participation in the Zehnder Group Management Share Plan (ZGMSP), and occupational pension benefits and perquisites.

The compensation mix targets a ratio of 50% fixed (annual base salary, ABS), 25% variable short-term (short-term incentive, STI) and 25% variable long-term (long-term incentive, LTI) compensation in case of expected performance.

Architecture of compensation of the Group Executive Committee

Purpose | Drivers | Performance measures | Vehicle | |||||

Annual base salary (ABS) | Attract and retain | Position, experience, and qualifications | Monthly cash payments | |||||

Variable short-term compensation (short-term incentive, STI) | Pay for performance | Annual business performance | Group net profit | Annual cash payment | ||||

Variable long-term compensation (long-term incentive, LTI) | Reward long- term, sustainable performance; align with shareholders’ interests; retain | Role and area of responsibility | relative Total Shareholder Return (rTSR); increase in Earnings Per Share (EPS); Gender ratio in management level; CO2e emission reduction Scope 1&2 | Conditional rights to restricted shares A (Performance Share Units) | ||||

Zehnder Group Management Share Plan (ZGMSP) | Promote shareholder ownership; retain | Level of position | Share price evolution | Discounted registered shares A | ||||

Benefits | Protect against risks, attract, and retain | Market practice and position | Retirement plan, insurances, perquisites |

4.1 Annual base salary (ABS)

The annual base salary is determined individually based on the scope and responsibilities associated with the position, and the experience and qualifications of the individual. The annual base salary is reviewed annually, and adjustments reflect individual performance, current salary level compared to relevant benchmark data, and the affordability of the company.

4.2 Variable short-term compensation (short-term incentive, STI)

The STI enables the Group Executive Committee to participate in the Group’s current success. It is disbursed in the form of a cash payment as a profit-sharing plan. For each position, a profit-sharing amount (as a factor) is determined, considering the impact on the operating result, implementation of company strategy, and responsibilities. The STI amount paid for the fiscal year corresponds to the profit-sharing amount (factor) multiplied by the Group net profit (in EUR million). The STI is paid only if a Group net profit of at least 80% of the budget value is achieved. This aligns with the STI principles of the other executives of Zehnder Group. There is no formal target based on the profit-sharing model, but there is a contractually agreed maximum limit for the STI amount of 100% of the annual base salary for all members of Group Executive Committee.

Calculation of the STI amount:

Individual profit-sharing amount (EUR) / factor | x | Group net profit (EUR million) | = | STI amount (EUR) | ||

Example | 2,000 | 50 | 100,000 |

The STI amount for any given fiscal year is paid in the spring of the following year. In the event of significant inorganic effects (investments, divestments) with an impact of ≥ 2% of the Group sales and/or other special one-off effects such as restructuring costs not budgeted in the plan year but Board-approved and/or extraordinary significant valuation adjustments or impairments, the Board of Directors reserves the right to adjust the STI payout calculation, and to report transparently in such a case.

The decision to exclusively and directly link the STI to the company’s financial result (Group net profit) is based on the conviction that individual performance management should not be directly linked to compensation. The main focus for the STI is on the collective performance as a whole. For the CEO and the other members of the Group Executive Committee, within the framework of the global performance management process, the performance objectives are derived directly from the business strategy by the Board of Directors at the start of each year and reviewed at regular intervals. Such reviews take place at the request of the Nomination and Compensation Committee.

In case of termination of employment during the first half of the fiscal year, the STI is calculated pro rata temporis, based on the payout level of the previous year. In case of termination of employment during the second half of the year, the published half-year figures for the pro rata temporis calculation are used. In case of termination of employment at the end of the fiscal year, the published annual results apply.

The STI is subject to clawback and malus provisions in case the company is required to prepare a relevant accounting/financial restatement or in the event of a violation of legal provisions or relevant internal regulations.

4.3 Variable long-term compensation (long-term incentive, LTI)

As part of a long-term plan, the LTI is granted in the form of Performance Share Units (PSUs). The LTI rewards the long-term performance and the sustainable success of Zehnder Group and is aligned with the interests of the shareholders.

A PSU represents a conditional right to receive shares of the company. The prerequisite for this is the fulfilment of certain conditions during the three-year performance period (vesting period). The vesting conditions include the attainment of the predefined performance objectives (performance conditions) and the continuous and ongoing employment at the end of the vesting period (service condition).

The features of the LTI can be summarised as follows: at grant date, the LTI target amount is determined for each member of the Group Executive Committee, taking the relevant benchmark for the individual total compensation into account.

In 2024, the allocation of the LTI target amount was 50% of the base salary for the CEO and no more than 50% of the base salary for the other members of the Group Executive Committee.

On the grant date, the individual LTI target amount is converted into the relevant number of PSUs based on the volume-weighted average share price of Zehnder Group on the SIX Swiss Exchange in the period between 1 October and 31 December of the year before the grant date.

Performance conditions

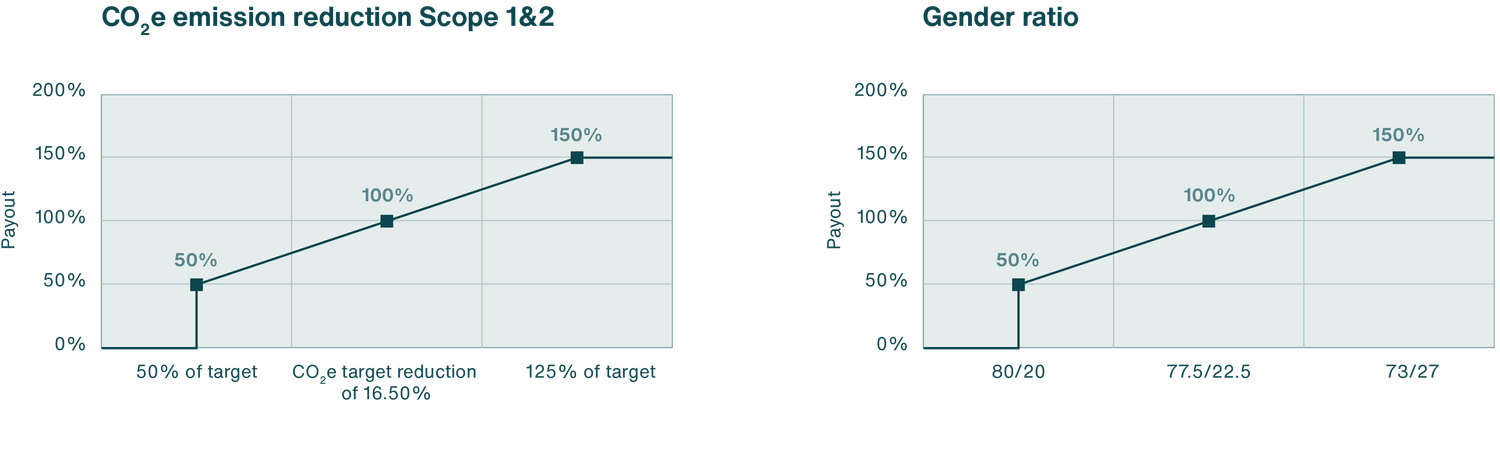

The performance conditions for the LTI granted in 2024 include new ESG key performance indicators such as gender ratio (male vs. female/diverse) at management level – weighted at 15% – and CO2e emission reduction (Scope 1&2) to achieve our reduction goal by 2033 –weighted at 15% – alongside the financial performance conditions of relative Total Shareholder Return (rTSR), now weighted at 35%, and the remaining 35% weighting based on the increase in Earnings Per Share (EPS growth).

The performance condition of gender ratio at senior and middle management level emphasises the ambition to achieve a more balanced gender ratio in management. The result will be evaluated as an absolute gender ratio in per cent at the end of the three-year vesting period.

In order to strengthen the Zehnder Group’s commitment to a net-zero strategy by 2050, starting with the base year 2023 with the respective reduction target for CO2e emissions in Scope 1&2 of achieving a 55% reduction by 2033, the LTI plan now features a CO2e emissions reduction performance condition. The applicable reduction of CO2e emissions is the cumulative reduction over the three-year period. Baseline recalculations, restatements, and any significant other effects that have an impact on the target achievement and payout calculation follow the terms and conditions according to the Science Based Targets initiative (SBTi).

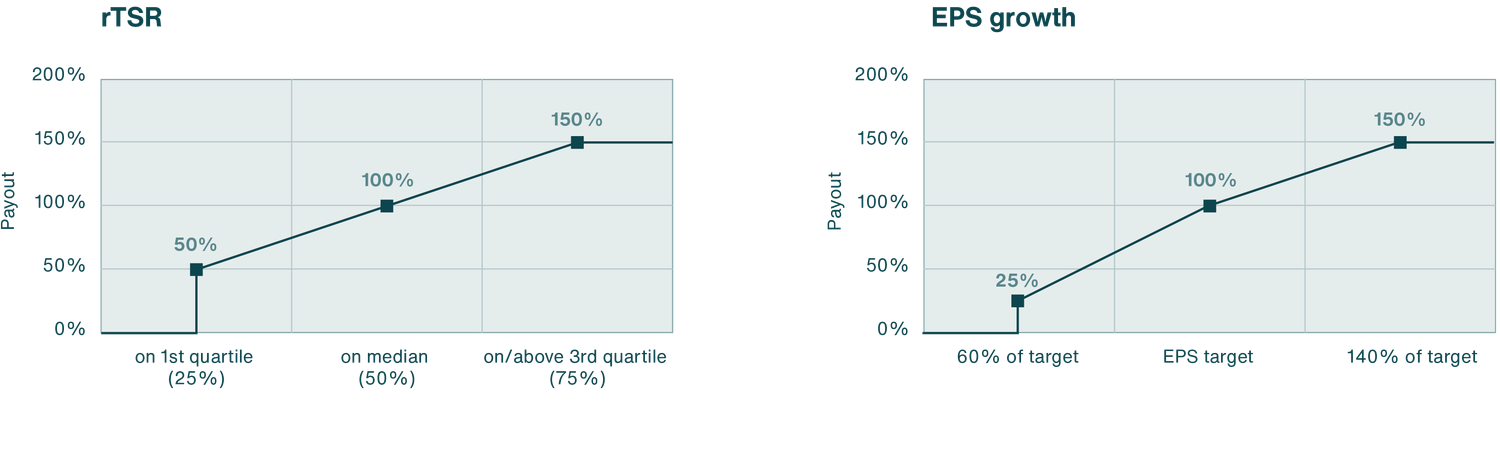

The rTSR is the achieved increase in value for the investor (i.e. the share price performance plus dividend) in comparison to a peer group. The achievement of the relative performance measure is calculated by an external independent consultancy company.

The peer group for the relative TSR (rTSR) measure comprises comparable companies that have already been considered for compensation benchmarking purposes. The Board of Directors confirmed that the following companies were comparable:

Arbonia | Belimo | Bossard | Burckhardt Compression |

Burkhalter | Bystronic | Daetwyler | Feintool |

Forbo | Gurit | Huber+Suhner | Interroll |

Komax | Landis+Gyr | Meier Tobler | Phoenix Mecano |

Rieter | Schweiter Technologies | Starrag | V-Zug |

The performance condition Earnings Per Share growth (EPS growth) is designed to reward an increase in EPS of Zehnder Group. The EPS growth target for the period from the fiscal year of the grant date and the two immediately following fiscal years compared to the net profit per registered share A excluding minority interest (in EUR) in the fiscal year preceding the grant date will be calculated based on the compound annual growth rate (CAGR). EPS growth is applicable, before minority interests and subject to any adjustment for extraordinary items. The Board of Directors reserves the right to adjust the payout calculation in case of significant inorganic effects (investments, divestments) with an impact of ≥ 7.5% of the Group sales and/or other special one-off effects such as restructuring costs which are Board-approved and/or extraordinary significant valuation adjustments or impairments with a cumulative annual impact in the year of vesting of ≥ 4 million EUR loss on net profit.

Rewarding long-term performance

The total number of shares that are transferred to the participants after the vesting period is calculated as shown below. The performance factor can range between 0% and 150%, with no conversion into shares carried out below the threshold. The conversion into shares is limited to a maximum of 1.5 shares per PSU.

The performance level for each performance condition has been approved by the Board of Directors for the long-term incentive plan (LTI) with a grant date in 2024.

Each weighted at 15%, the sustainability performance conditions scope 1&2 CO2e emissions reduction and gender ratio exhibited the following performance:

Each weighted at 35%, the financial performance conditions rTSR and EPS growth exhibited the following performance:

If Zehnder Group reports a negative profit after tax from continuous operations (a loss) in the vesting year, the PSUs will be forfeit, irrespective of the performance factor achieved. However, in any exceptional circumstances not explicitly covered by the LTI plan rules, the Board of Directors has the discretion to determine appropriate other measures regarding the vesting of PSUs and/or determining the performance factor, and to report transparently in such a case.

In the case of termination of employment, the blocked PSUs are usually forfeit, except in the event of retirement, disability, death, or a change of control at the company. These provisions are outlined individually in the table below.

Reason for release | Plan rules for blocked PSUs |

Termination by employee | Forfeiture |

Termination of employment by employer for good cause | Forfeiture |

Termination of employment by employer (other causes) | Forfeiture or pro-rata vesting based on discretion of the Board of Directors |

Retirement | Discretion of the Board of Directors |

Disability | Pro-rata vesting, based on effective performance at regular vesting point in time |

Death | Accelerated pro-rata vesting based on target performance (100% payment factor) |

Change of control | Accelerated, full vesting based on effective performance at the point of change of control (except if the plan is continued or replaced with an equivalent) |

PSUs or shares granted as part of the long-term plan are subject to the same clawback and malus provisions as the STI.

In the event of a participant failing to adhere to reporting regulations and/or committing fraud and/or breaching legal provisions or relevant internal regulations, the applicable clauses enable the Board of Directors to declare that any variable cash compensation elements that have not been paid out or long-term incentives that have not yet been transferred are forfeited, either in part or in full (penalty clause), and/or to reclaim in part or in full any variable cash compensation elements that have been paid out or long-term incentives that have been transferred.

Shareholding guidelines

To align the interests of the Group Executive Committee with those of the shareholders, shareholding guidelines are applicable. Within five years after their appointment to the Group Executive Committee, the members of the Group Executive Committee must hold at least a multiple of their annual base salary in Zehnder Group shares, as shown in the table below.

% of annual base salary | |

CEO | 200% |

Other members of the Group Executive Committee | 150% |

CEO: Chief Executive Officer

At the end of 2024, all members of Group Executive Committee have fulfilled the requirements of the shareholding provision, except for those who were appointed within the last four years and still have time to build up and fulfil the required shareholding.

4.4 Long-term benefits: Zehnder Group Management Share Plan (ZGMSP)

The Zehnder Group Management Share Plan (ZGMSP) is a long-term benefit programme with the objective to encourage members of the Group Executive Committee and employees at management level to directly participate in the long-term success of the company. The Group Executive Committee members may elect to draw up to 30% of their annual base salary in the form of Zehnder Group registered shares A. These shares are offered at a discount of 30% on the relevant share price determined as the volume-weighted average share price of the share in the period between 1 October and 31 December of the preceding year. The shares are subject to a blocking period of three years during which they cannot be sold, transferred, or pledged. The blocking period also applies in case of termination of employment, except in the case of death or a change of control, where the restriction immediately lapses.

The ZGMSP strengthens the link between compensation and the company's long-term performance, as the compensation invested in the programme is exposed to the change in the share value over the restriction period of three years.

4.5 Benefits

As the Group Executive Committee is international by nature, the members participate in the benefit plans available in the country of main residence (social insurance payment obligation). Benefits consist mainly of retirement, insurance and healthcare plans. These benefits are designed to provide a reasonable level of protection for the employees and their dependents in respect of retirement, the risks of disability, death, or illness/accident.

For members of the Group Executive Committee subject to social security contributions in Switzerland, the defined insured salary is insured up to 450% of the maximum AHV retirement pension in the pension fund (currently the mandatory part is set at CHF 132,300). This solution is offered to all employees in Switzerland. The supplementary part of the defined insured salary is insured up to a maximum of 3,000% of the AHV retirement pension (currently CHF 882,000) for members of the Group Executive Committee by a 1e pension solution. Zehnder Group covers 50% of the savings contributions. The 1e solution gives the members of the Group Executive Committee more flexibility in investing their retirement savings and at the same time allows the risk of the investment to be fully borne by them. Zehnder Group's pension benefits exceed the legal requirements of the Swiss Federal Law on Occupational Retirement, Survivors and Disability Pension Plans (BVG) and are comparable with the conditions offered by other international industrial companies.

Members of the Group Executive Committee subject to social security contributions outside of Switzerland are insured in line with the local legal requirements and based on local market practice in their position. Each plan may vary depending on the respective legal requirements.

In addition, the members of the Group Executive Committee are also eligible for standard perquisites such as a company car, child allowances, access to subsidised staff restaurants, and other benefits in kind, according to local market practice. The monetary value of these other compensation elements is evaluated at market value and is included in the compensation tables.

Expenses that are not covered by the expense allowance in accordance with the company’s expenses regulations are compensated on presentation of documentary evidence. The reimbursement of business expenses is not considered compensation and does not need to be approved by the Annual General Meeting.

4.6 Contracts of members of the Group Executive Committee

The employment contracts of the members of the Group Executive Committee are unlimited. They incorporate a notice period of a minimum of six and a maximum of twelve months and feature a non-competition clause, which is limited to two years after termination of the employment relationship while providing an entitlement to a maximum of the annual base salary. There are no agreements regarding withdrawal payments or severance compensation in connection with leaving the company or in the case of a change of control, except for the accelerated vesting of the PSUs or early unblocking of shares (ZGMSP), as described above.