Corporate Governance

1. Group structure and shareholders

1.1 Group structure

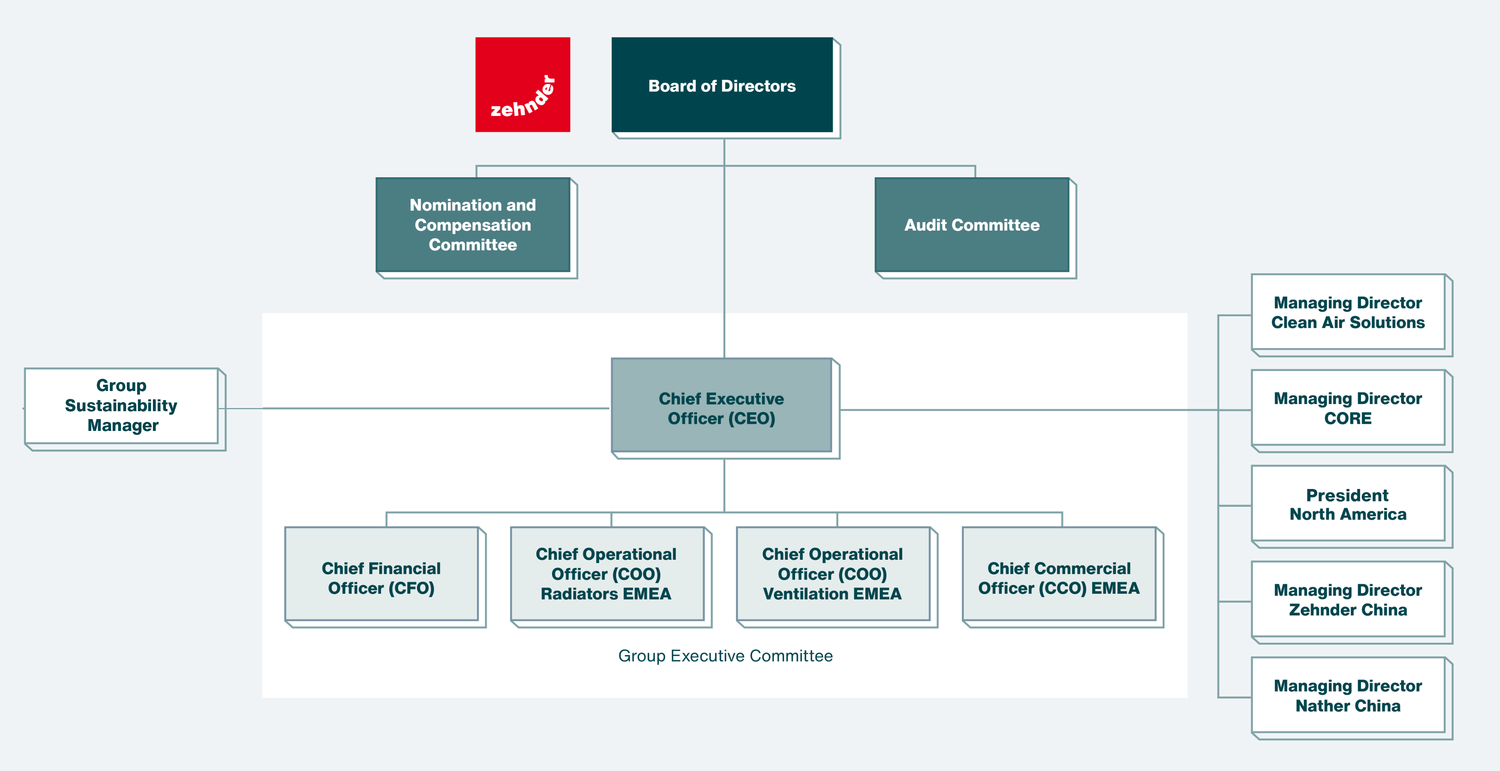

Zehnder Group follows a differentiated structure. From an EMEA perspective, it is organised into the two segments, ventilation and radiators, whereas the divisions Clean Air Solutions and CORE are organised separately. Eventually, the two divisions of North America and China are organised by country region. While the Managing Directors and Chief Officers report directly to the CEO, the Group functions report either to the CEO or the CFO.

Zehnder Group AG, the holding company of Zehnder Group, is the only listed company included in the consolidation scope. It is headquartered in Gränichen (CH). The registered shares A are listed on the SIX Swiss Exchange (number: 27 653 461, ISIN: CH0276534614). The unlisted registered shares B (nominal value CHF 0.01) are held by Graneco AG, which is controlled by the Zehnder families. As of 31 December 2024, the market capitalisation (registered shares A) was CHF 418.9 million and the total capitalisation was CHF 508.4 million.

All companies included in the consolidation scope of Zehnder Group AG are shown in the Overview of Companies in the consolidated financial statements within the Financial Report.

Zehnder Group organisational chart

1.2 Significant shareholders

According to the information available to the Board of Directors, the following shareholder held more than 3% of the share capital of Zehnder Group AG as at the balance sheet date, i.e. 31 December 2024:

- Graneco AG, Gränichen (CH): 6,840 registered shares A and 9,900,000 registered shares B, corresponding to 51.7% of the votes (previous year: 50.4%); together with the other registered shares of the company held by the shareholders of Graneco AG, this group holds 53.4% of the voting rights.

There is a shareholders’ agreement between the shareholders of Graneco AG (the Zehnder family and persons closely associated with the Zehnder family). It is the intention of this group of persons to ensure significant influence over Zehnder Group AG over the long term. For important decisions they vote together, putting the successful development of Zehnder Group before their own interests. The agreement was renewed on 23 November 2022 and runs until at least 31 December 2032.

As of 31 December 2024, Zehnder Group AG held 110,989 of its own registered shares A. These were acquired as part of the employee shareholding plan and the variable long-term compensation (LTI) for the Group Executive Committee members.

For notification of the disclosure of significant shareholdings, please refer to the SIX Swiss Exchange website: Significant Shareholders (ser-ag.com)

The Articles of Association of Zehnder Group AG provide an opting-out clause, which is explained in item 7.1 Duty to make an offer of this Corporate Governance Report.

1.3 Cross-shareholdings

There are no cross-shareholdings.