Six-month Report 2025

Management Report Financial ReportManagement Report

Dear shareholders,

In the first half of 2025, Zehnder Group's sales and operating result in the ventilation segment in Europe and North America increased significantly compared to the previous year. Sales in the ventilation segment grew both organically and through the acquisition of Siber in Spain in July 2024. Increased construction activity in some countries, the expansion of our market share, and a build-up of stock on the customer side had a positive impact on sales development. In contrast, sales in the radiator segment continued to decline.

Signs of recovery in various countries in the ventilation segment became more pronounced during the first half of the year. The positive trend indicates that demand has bottomed out in various countries. Nevertheless, uncertainty remains for the second half of 2025 due in part to the ongoing tariff situation in the USA. At the same time, the geopolitical situation is dampening general investment sentiment.

We want to further strengthen our market position through a focused strategy and targeted investments in innovation and sustainability. We are systematically pursuing our transformation into a leading international supplier of indoor climate systems.

In addition, we are continuing to expand our service and maintenance business with the aim of reducing our dependence on the new building cycle.

Key figures 1st half-year

1st half-year 2025 | 1st half-year 2024 | Change from prior year in % | ||

Sales | EUR million | 382.8 | 344.7 | 11.0 |

EBITDA adjusted 1, 2 | EUR million | 44.9 | 35.0 | 28.2 |

% of sales | 11.7 | 10.2 | ||

EBITDA 1 | EUR million | 44.9 | 25.2 | 78.3 |

% of sales | 11.7 | 7.3 | ||

EBIT adjusted 1, 2 | EUR million | 32.7 | 22.6 | 44.7 |

% of sales | 8.5 | 6.6 | ||

EBIT | EUR million | 32.7 | 12.5 | 161.8 |

% of sales | 8.5 | 3.6 | ||

Net profit 3 | EUR million | 23.5 | 7.1 | 229.0 |

% of sales | 6.1 | 2.1 | ||

Cash flow from operating activities | EUR million | 22.9 | 14.3 | 59.7 |

% of sales | 6.0 | 4.2 | ||

Research & development expenses | EUR million | –12.7 | –13.0 | –2.4 |

% of sales | –3.3 | –3.8 | ||

Investments in property, plant and equipment & intangible assets | EUR million | 7.5 | 8.4 | –11.6 |

Depreciation, amortisation & impairment | EUR million | –12.2 | –12.7 | –3.8 |

Total assets | EUR million | 476.9 | 489.7 | –2.6 |

Non-current assets | EUR million | 203.0 | 218.6 | –7.2 |

Net liquidity/(net debt) 1 | EUR million | –12.6 | 53.0 | n/a |

Shareholders’ equity | EUR million | 244.5 | 333.2 | –26.6 |

% of total assets | 51.3 | 68.0 | ||

Number of employees | Ø full-time equivalents | 3,611 | 3,529 | 2.3 |

Market closing price registered share A | CHF | 67.00 | 52.80 | 26.9 |

Registered shares A (CHF 0.05 par value) | Units | 9,268,200 | 9,268,200 | - |

Own shares | Ø Units | 118,658 | 337,334 | –64.8 |

Registered shares B (not listed; CHF 0.01 par value) | Units | 9,900,000 | 9,900,000 | - |

Non-diluted net profit per registered share A 3 | EUR | 2.06 | 0.60 | 242.9 |

Shareholders’ equity per registered share A 3 | EUR | 21.2 | 29.2 | –27.4 |

1For further information please refer to: Alternative performance measures.

2No one-off effects in 2025. In 2024, the one-off effects consist of EUR 8.1 million related to the divestment of the Climate Ceiling Solutions business and other European restructuring costs of EUR 2.0 million.

3Excluding minority interests

Company profile

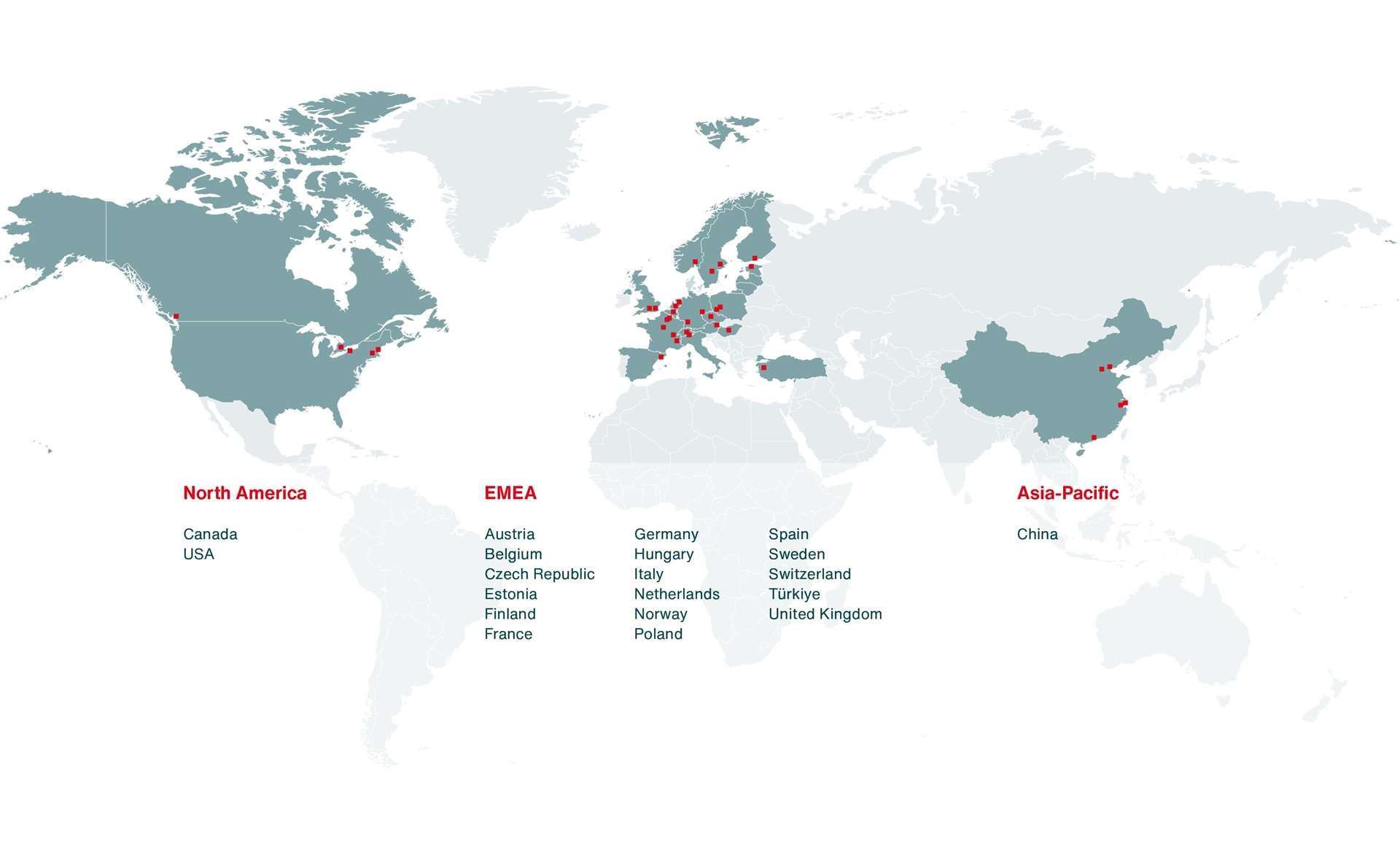

Zehnder Group provides worldwide leading solutions for a comfortable, energy-efficient and healthy indoor climate. The products and services of the Group include heating, cooling, indoor ventilation and air cleaning. The Group develops and manufactures its products at its own factories in Europe, China and North America. In the 2024 financial year, Zehnder Group had about 3500 employees and achieved sales of EUR 706 million. The company is listed on the SIX Swiss Exchange (symbol: ZEHN, number: 27 653 461). The unlisted registered shares B are held by Graneco AG, which is controlled by the Zehnder families.

Locations

Further information for investors

Contact

Zehnder Group AG

Investor Relations

Moortalstrasse 1

5722 Gränichen (Switzerland)

Phone +41 62 855 1521

investor-relations@zehndergroup.com

www.zehndergroup.com

Registered share A

Valor number | 27 653 461 |

SIX | ZEHN |

Bloomberg | ZEHN SW |

Reuters | ZEHN S |

In accordance with Art. 10 of the Articles of Association, the opting out clause applies.

Registered share B (unlisted)

Valor number | 13 312 654 |

Company calendar

End of business year | 31.12.2025 |

Sales for 2025 | 16.1.2026 |

Integrated Annual Report 2025 and Media/Analyst Conference 2026 | 26.2.2026 |

Annual General Meeting 2026 | 19.3.2026 |

Six-month Report 2026 | 30.7.2026 |

This Six-month Report is only available in English. The Management Report is also available in German. The English version is binding.

News is published under www.zehndergroup.com/en/news.

Reports and presentations are published under www.zehndergroup.com/en/investor-relations/reports-and-presentations.